If you’ve been trying to source authentic Japanese matcha this year, chances are you’ve noticed two things: it’s harder to get, and it costs a lot more. Behind those rising prices lies a story of climate pressure, surging global demand, and a centuries-old tea tradition adjusting to modern reality.

If you’ve been trying to source authentic Japanese matcha this year, chances are you’ve noticed two things: it’s harder to get, and it costs a lot more. Behind those rising prices lies a story of climate pressure, surging global demand, and a centuries-old tea tradition adjusting to modern reality.

The Rise and Strain of Japan’s Matcha Market

Matcha – Japan’s finely milled green tea has held cultural significance far beyond its delicate vegetal flavour for centuries. But in 2025, matcha isn’t just a ceremonial drink; it’s a global wellness icon. Gen Z, in particular, has embraced it as a “clean caffeine” alternative to coffee. And from Los Angeles to Riyadh, demand is booming.

But that growing appetite is colliding with nature’s limits.

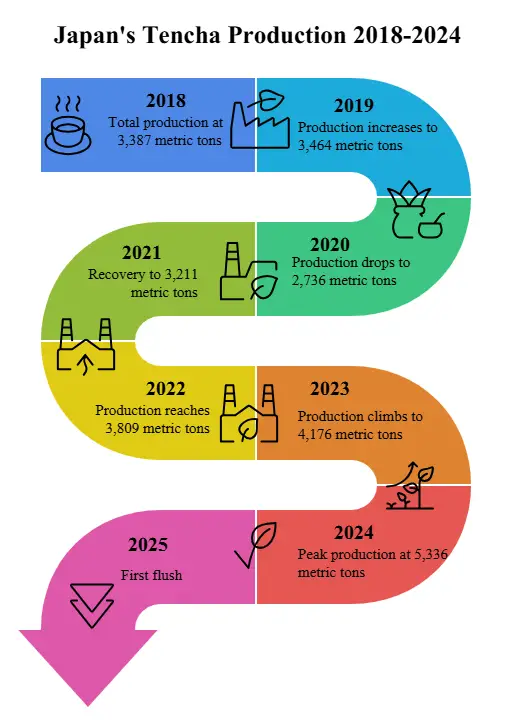

In Japan, matcha is prepared from Tencha, a shade-grown leaf that is steamed and dried before being ground into a fine powder. Despite careful management, tencha production remains highly susceptible to climate variability.

According to the Japan Tea Central Association, Japan harvested 5,336 metric tons of Tencha in 2024, the highest on record. However, the 2025 first flush showed signs of serious stress: Kyoto, Japan’s core region for high-quality matcha, produced only 460 tons, or 87% of its 2024 first flush volume. One insider described the weather as “horrible” reflecting the toll taken by recent heatwaves and unstable growing conditions.

What’s Driving Prices Up?

Scarcity is only half the story. Prices have also skyrocketed.

According to official market data from JA Kyoto, the average price for first flush Tencha in Kyoto rose from JPY 5,500/kg in 2024 to JPY 14,333/kg in 2025 — a 265% increase.

And the trend is even more extreme for organic teas. Farmers at the Kagoshima tea market report that organic Aracha, the raw, unrefined leaf used to make matcha and other teas, is sold at double or triple the 2024 price.

What’s Aracha?

It’s the “crude tea” — leaves that are dried but unrefined. Aracha is the base ingredient that’s later processed into Gyokuro, Sencha, Bancha, and Matcha.

Global Demand: From Dubai to Dallas

This surge in prices isn’t driven only by weather and supply limits; it’s also a story of explosive international demand.

Over the past few years, new high-spending markets like the UAE and Saudi Arabia have joined traditional US and European buyers. As one Japanese tea merchant noted:

“Due to incredible purchasing power and demand from around the world, almost all Japan’s matcha is exported overseas.”

In other words, premium matcha is likelier to appear in cafes in Riyadh or Paris than on a supermarket shelf in Tokyo.

Quality Questions and “Fake Matcha”

With global demand rising and prices soaring, a wave of “fake matcha” has emerged. These are typically lower-grade powdered green teas sold under the matcha name.

True matcha is made from carefully shade-grown Tencha, slowly stone-milled into a fine powder. These imitations, often sun-grown leaves ground rapidly at high temperatures, lack the rich umami, fine mouthfeel, and slow-release caffeine of authentic matcha.

Some in the industry are pushing for clearer definitions: distinguishing between authentic matcha and “fine-milled green tea” could help prevent misuse of the term while still offering a broader product range to meet demand.

A Global Drink With Local Roots

As Japan’s tea farmers wrestle with rising temperatures and evolving consumer markets, matcha’s place in the world is shifting.

Once a sacred component of the tea ceremony, matcha is now a fast-moving consumer product. Yet behind each tin lies a craft still rooted in tradition: leaves shaded under rice straw canopies, picked by hand, and carefully stone-ground, often in small family-run facilities.

That heritage is under pressure. In the coming years, farmers, buyers, certifiers, and consumers will make choices that will shape the future of matcha for a global audience.

Data Source:

Production and market data referenced in this report are provided by ITC’s Associate Member in Japan, the “Japan Tea Central Association (日本茶中央会)”, July 2025.

Have you noticed changes in matcha quality or availability this year? Are you seeing new trends in pricing or sourcing? We’d love to hear from you.